IRS whistleblowers seek dismissal of Hunter Biden lawsuit against tax agency, citing ‘protected disclosures’

IRS whistleblowers Gary Shapley and Joseph Ziegler, who accused the Justice Department of attempting to cover up the investigation in the Hunter Biden case, filed a lawsuit on Friday seeking to dismiss the lawsuit against the tax agency filed by the first son.

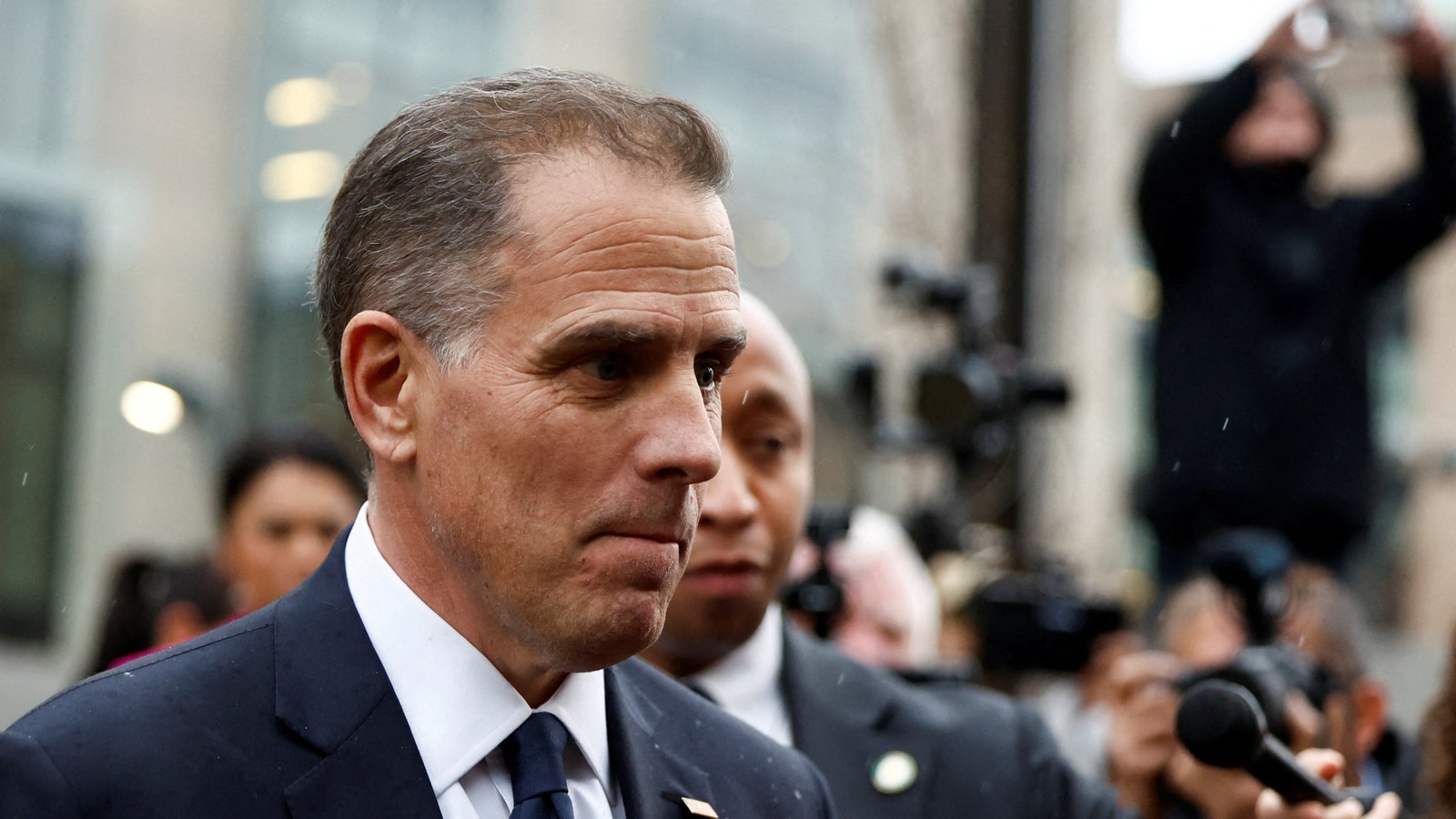

Hunter Biden, son of U.S. President Joe Biden, departs following a closed deposition with members of the Republican-led House Oversight Committee conducting an impeachment inquiry into the president, at the O’Neill House Office Building in Washington, U.S., February 28, 2024. REUTERS/Evelyn Hockstein/File Photo(REUTERS)

Biden, who is just 54 years old, took the IRS to court last September, demanding the court investigate the leaked tax information, which he considered was tampered with inappropriately. He alleged that the tax whistleblowers Gary Shapley and Joseph Ziegler, an IRS supervisory special agent who published his tax information publicly, deprived him of his right to privacy and tried to “embarrass” him.

Unlock exclusive access to the latest news on India’s general elections, only on the HT App. Download Now! Download Now!

Nor Shapley nor Ziegler are being named as defendants in the lawsuit; the only party name is IRS, which they tend to be accused of having a conflict of interests between the parties involved that may result in the IRS failing to defend their legally authorized “protected disclosures as legally authorized.”

ALSO READ| Joe Biden’s aides concerned about his growing anxiety over son Hunter’s gun case trial: ‘He worries every single day’

Tristan Leavitt, president of Empower Oversight and representative for Shapley, noted, “Normally a lawsuit like this would be defended by DOJ’s Federal Programs Branch.”

He pointed out, “But instead, DOJ assigned two attorneys from the Tax Division – one of the very offices Shapley and Ziegler blew the whistle on.”

“DOJ’s client here is the IRS – the same agency that took the whistleblowers off the Hunter Biden case, imposed illegal gag orders on them, and tried to make it look in Hunter’s criminal prosecution like the whistleblowers are under investigation.”

DOJ reluctance exposes conflict in Hunter Biden IRS lawsuit, whistleblowers say

The whistleblowers’ motion to intervene underscores the DOJ Tax Division’s reluctance to dismiss the lawsuit and defend the whistleblowers’ disclosures in earlier filings, which “exposes the clear conflict between the interests of the Plaintiff Hunter Biden, the whistleblowers, and the governmental entities on which they blew the whistle.”

The legal document asserts, “The bottom line remains that Shapley and Ziegler did not violate the law in their disclosures and need the opportunity to intervene to defend their interests.”

Leavitt dropped a letter to Attorney General Merrick Garland last month expressing his apprehension that the DOJ was “bizarrely ignoring the key statutory provision” that legitimized the disclosures made by Shapley and Ziegler. “Only then did DOJ finally drop a footnote in a filing last Friday that they don’t believe the IRS whistleblowers broke the law.”

“Yet DOJ is still not moving to dismiss Hunter Biden’s case in its entirety, despite several good-faith bases for doing so,” Leavitt said.

ALSO READ| Hunter Biden threatens Fox News with ‘imminent’ defamation suit over alleged ‘conspiracy’

Shapley and Ziegler had made their protected disclosures to the House Ways and Means Committee, which preceded the collapse of Biden’s plea deal in Delaware related to tax and gun charges.

The committee decided to make those interviews public, and subsequently, Shapley and Ziegler testified that the DOJ had hindered their investigation, including barring them from interviewing witnesses and examining evidence from Hunter Biden’s discarded laptop.

Biden’s legal battle against the IRS includes a demand for a $1,000 compensation for each instance of “unauthorized” tax disclosure, along with litigation charges and an unspecified sum in punitive damages.